How OpenVC Is Fixing Fundraising for Founders

An Unfiltered Conversation with OpenVC Co-Founder, Stephane Nasser

Quick Insights

Startup snippets 🔎

AI Models Are Multiplying Like Gremlins 🔥

Hugging Face now hosts 1.4 million models. Most are junk. But a few can seriously accelerate product dev if you know where to look. Knowing which models to use is now a startup skill.Your TV Is Watching You 👁️

Roku and Amazon are mining viewing data to track behavior and personalize sales. Startups selling into consumer markets need to understand how that data game works and where the lines are shifting.Ghibli Goes Viral. Miyazaki Would Not Approve 🎨

OpenAI’s latest image model is going viral for its Ghibli-style portraits. Fun, sure but the real signal is how fast AI is eating visual branding. If you’re building anything creative, the bar for originality just moved again.

The psychology behind startups 🧠

Why founders overestimate their chances of raising:

The optimism bias convinces you you're the exception. But studies show people systematically overestimate their odds in uncertain situations. Especially when ego’s involved. That’s why so many founders chase doomed raises instead of building traction.

This Week's Reality Check ✅

Fundraising sucks. OpenVC is trying to fix it.

The OpenVC Story

Founders know it. VCs know it.

But for years, the industry has been built on gatekeeping, warm intros, and who-you-know networks that lock most founders out.

Stephane Nasser is changing that. As the co-founder of OpenVC, he’s ripping down the velvet rope and building a platform where founders can actually connect with investors without begging for intros.

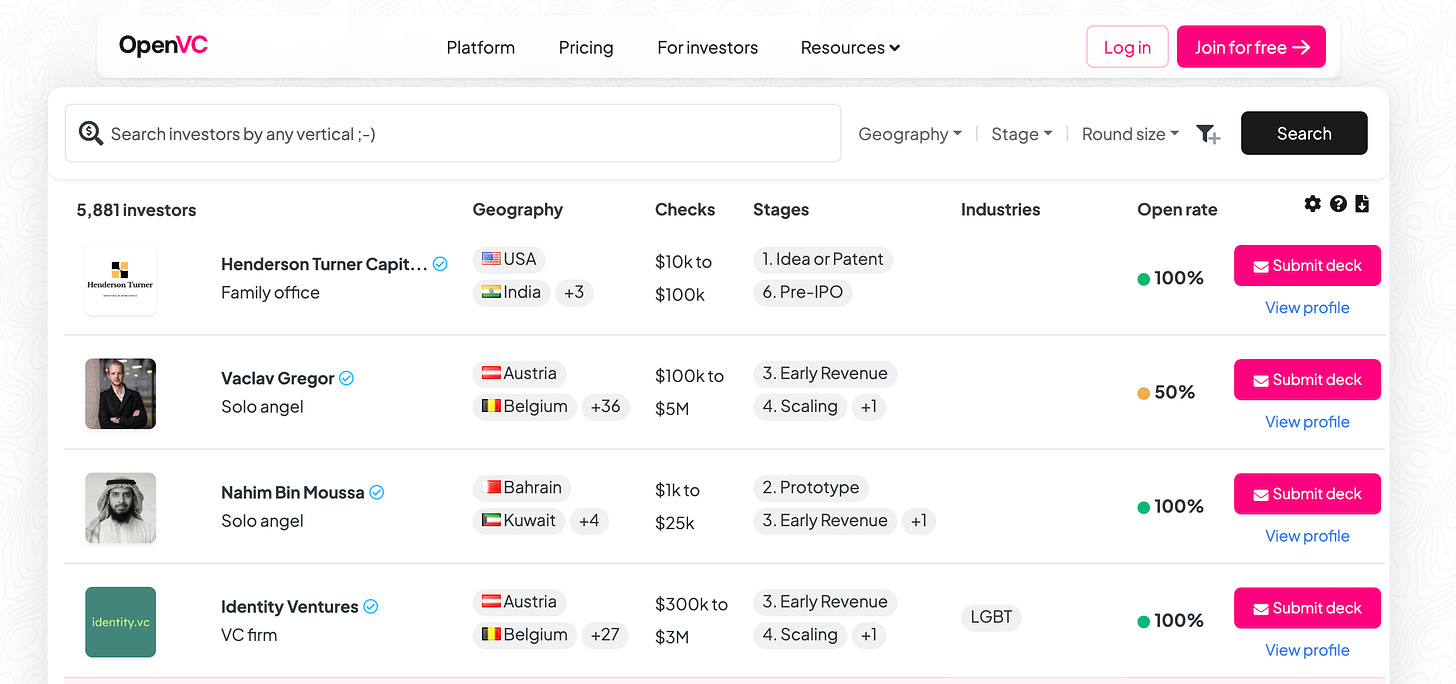

OpenVC helps you skip the gatekeeping and get straight to the pitch. Find investors. Track your raise. Share your deck. All free.

No warm intros. No BS. No hidden fees.

For founders who want to go faster, there’s also a Premium plan with extra firepower.

In this interview, we break down:

✅ What makes VCs actually write checks

✅ Why most fundraising advice is garbage

✅ How to avoid burning months on a raise that was doomed from day one.

An unfiltered conversation with OpenVC Co-Founder, Stephane Nasser.

Q: What was the moment that made you say, “Screw this, we need to fix VC fundraising”?

Stephane: Honestly? There was no dramatic “screw this” moment. OpenVC started as a side project, and we spent two years slowly building it before going full-time at around $5K MRR.

But the frustration with fundraising has been there for me since day one. Back when I was at Microsoft Accelerator handling deal flow, I saw first-hand how broken the system was. Now, we’re actually in a position to do something about it.

Q: The VC world runs on gatekeeping. You’re breaking that. What’s been the reaction from investors?

Stephane: There are two kinds of investors.

The big names such as Sequoia, A16Z, etc. ignore us. They run on warm intros, and they don’t need us to source deals.

But the other 95% of investors? The long tail of VC’s, local firms, emerging managers, corporate VC’s, solo angels, well they love OpenVC. They need a steady deal flow, and we give them that.

And because we don’t charge equity or success fees, it’s a total no-brainer for them.

Q: You see 300+ decks a week. What’s the #1 mistake that makes you instantly pass?

Stephane: Founders love writing a novel in size 11 font.

They think their deck needs to explain everything such as the vision, the product, the market, the team, their childhood dream of building this company.

Wrong.

A deck’s job isn’t to close a round. It’s to get a meeting. Just like Tinder, you want to spark interest, not dump your life story on the first swipe.

Q: What’s the worst advice founders keep repeating?

Stephane: The whole “fundraising is hard, just keep pushing” narrative is a trap.

Yes, fundraising is tough but some founders are wasting months on a raise that was never going to happen.

They walk into meetings with zero chance of getting a check. No traction, no validation, no plan but they’ve been told to “persist.”

They should’ve spent that time actually building a business.

Q: VC’s always say they want to ‘see traction.’ But what’s the real signal that makes them write checks?

Stephane: Traction is a spectrum.

Growing 20% per month? Maybe you’ll raise. Maybe you won’t.

Growing 20% per day (like Coinbase when they raised)? You’re getting funded. Period.

But traction alone isn’t enough. Investors care just as much about the founder’s track record. If you haven’t built and exited before, your traction needs to be off the charts to make up for it.

Q: ‘Pattern matching’ is just bias with a suit on. How do founders who don’t fit the mold still win?

Stephane: No secret hack here…

If your track record is weak, you need ridiculous traction.

That means:

✅ Self-funding the early version

✅ Building with no-code and AI to move fast

✅ Stacking small wins such as grants, accelerators, partnershipsIt’s a grind. But for 95% of founders, this is reality.

Just don’t expect to read about it on TechCrunch. Not sexy enough.

Q: If a founder had 30 minutes to level up their fundraising game, what should they do?

Stephane: Do your homework.

Fundraising is a niche skill. You weren’t born knowing it. You won’t figure it out on the fly. Before you pitch a single investor, spend 2-4 hours studying how VC actually works.

Start here:

📌 The YC School fundraising videos (free on YouTube)

📌 This fundraising starter guide (I wrote it for founders)Because in fundraising, you get one shot at a first impression.

Don’t blow it.

Q: What’s the biggest BS metric you see in pitch decks?

Stephane: The classic: “40% MoM growth.”

Sounds great until you realize they went from $100 to $140.

Instant pass.

Q: Fundraising is a full-time job. How do the best founders systemize it?

Stephane: Fundraising = sales. Treat it like a process.

You need:

✅ An investor pipeline (your CRM for fundraising)

✅ Deck tracking (who’s seen what, who needs a follow-up)

✅ A clean data room (so due diligence doesn’t drag for weeks)Do this right, and you can close in 6 months or less.

Q: What’s next for OpenVC?

Stephane: 2025 is all about more direct access between founders and investors.

🚀 April: Auto-screening feature to pre-filter decks before they hit investor inboxes.

🚀 May: Multiplayer mode for intro networks let founders and advisors pool their investor intros.

🚀 June: Open Flow 2.0—reversing the game, letting investors request decks from founders (95% reply rate on v1).Busy days ahead.

Bonus Questions

📖 Best book on VC?

Stephane: I don’t read VC books. I binge-watch anime.

🎙️ Best podcast for founders?

Stephane: The OpenVC Podcast (shameless plug). We interview 2 VC’s a month on exactly how they invest.

📺 Guilty pleasure TV show right now?

Stephane: Anime… Dan Da Dan (season 1 was fire). Solo Leveling season 2. Rewatching all 10 seasons of Stargate SG-1. Highly recommend.

Recommended by Martin

📚 Book of the Week:

Secrets of Sand Hill Road by Scott Kupor. A blunt, founder-friendly guide to how VC really works. Less fairy dust, more deal mechanics. Written by someone who’s seen both sides of the table.

🛠 Tool of the Week:

Windsurf: An AI coder that actually helps you ship. Faster builds. Cleaner code. It’s like adding a junior dev who never sleeps.

🎧 Track of the Week:

"No One Knows" by Queens Of The Stone Age.

Final thoughts

Most founders obsess over fundraising.

They treat it like a rite of passage. But it’s not always rational.

If you really want to try raising, fine. Get it out of your system.

But make sure you:

⚠️ Don’t go broke in the process

⚠️ Have a plan B if it doesn’t work

Until next week keep building, no fairytales required.

Martin, Chief Ranter at Uncharted

P.S. Got questions or success stories to share? Just hit reply. I’d love to hear from you!

Great interview, Martin ... I especially loved the "40% MoM growth" reference ... haha, I remember how we used that metric in one of the startups I worked at in a similar case.